ZANU PF SCANDAL: DEALING AWAY THE PEOPLE’S SAVINGS

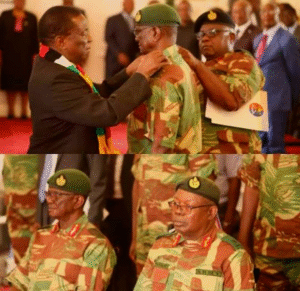

Zimbabweans have long lived under the shadow of questionable dealings within their government. Now, a new scandal involving President Emmerson Mnangagwa and Attorney-General Virginia Mabiza threatens the very foundation of public trust. The issue at hand? The arbitrary sale of the People’s Own Savings Bank (POSB), a state-owned institution vital to Zimbabwe’s financial infrastructure.

According to leaked documents, Mnangagwa and Mabiza are pushing to sell POSB to a shadowy consortium called Hebrew Investment Group (HIG). These so-called investors claim they will inject $70 million into the bank and loan the government a staggering $6 billion. This, on paper, seems promising, but upon closer inspection, the deal is deeply concerning.

HIG appears to be a questionable entity. The group has no corporate website, no verified track record, and no transparency regarding its operations. Its representatives, including controversial cleric Morris Brown Gwedegwe, raise more questions than answers. Yet, despite these red flags, the President seems entranced by the promise of billions.

What makes this deal even more troubling is that it bypasses standard public procurement processes. Instead of inviting competitive bids, Mnangagwa handpicked HIG. Mabiza, acting on his instructions, directed the deal to proceed without the thorough scrutiny that public assets demand. Such actions put the savings of countless Zimbabweans—especially civil servants and pensioners—at risk.

POSB is not just another bank. It processes a significant portion of civil servant salaries, distributes pensions, and provides salary-based loans. It is an essential part of many Zimbabweans’ lives. Yet, the proposed deal includes granting HIG access to the bank’s vaults without proper due diligence. This move could compromise the safety of customers’ hard-earned money.

The alleged $6 billion loan offered by HIG also appears too good to be true. Given Zimbabwe’s poor credit rating and economic challenges, such an offer should be met with skepticism. The terms—repayment over 30 years at 0.3% interest—seem unrealistic, raising concerns that this is more about money laundering and fraud than genuine investment.

Moreover, the role of Kenias Mafukidze, chairman of the POSB board, complicates matters further. Mafukidze, who also leads a private media company, finds himself in a conflicted position. Instead of using his platform to hold power to account, his entanglement with state-owned enterprises raises questions about impartiality and accountability.

This deal is a stark reminder of the dangers of unchecked political power. The decision to sell POSB without public tendering or transparent governance not only jeopardizes the bank’s future but also undermines public confidence in the country’s leadership. If the government cannot safeguard a vital institution like POSB, what hope is there for ordinary citizens’ financial security?

As Zimbabweans learn of these dealings, the need for vigilance and accountability becomes clearer than ever. The country’s future depends on ensuring that public resources are managed responsibly and transparently. This scandal is not just about one bank—it is about the integrity of Zimbabwe’s institutions and the trust of its people.