DEBUNKING MYTHS AND RESTORING TRUTHS: ZIMBABWE’S TUMULTUOUS MONETARY JOURNEY

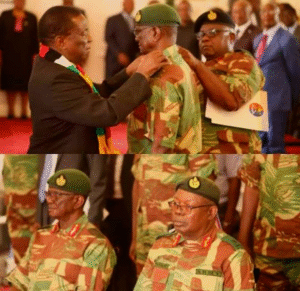

In a striking revelation at the Zimbabwe International Trade Fair in Bulawayo, Vice-President Constantino Chiwenga was caught misleading the nation about the origins of the recently abandoned bond notes. Contrary to his claims, these notes were not a colonial-era Rhodesian initiative but a contemporary financial strategy gone awry. The bond notes, introduced in a bid to stabilize Zimbabwe’s crumbling economy, faced severe depreciation due to high inflation and exchange rate volatility, leading to their hasty withdrawal.

In his statements, Chiwenga incorrectly attributed the bond notes to Ian Smith’s era, specifically linking them to the Unilateral Declaration of Independence. This misinformation contributes to ongoing confusion and mistrust among the public, particularly as the government introduces its new currency, the Zimbabwe Gold, or ZiG.

The rollout of ZiG has been marred by unhelpful and often contradictory statements from officials, undermining confidence in the new currency even before its market introduction. For instance, Zanu PF spokesperson Chris Mutsvangwa inaccurately described ZiG as a gold currency, falsely suggesting a historical precedent where Zimbabwe used bullion as currency. Moreover, Reserve Bank of Zimbabwe governor John Mushayavanhu added to the controversy by claiming that ZiG was developed in consultation with the World Bank, asserting that criticism of ZiG was tantamount to criticizing the World Bank itself. He also admitted that previous assertions about the bond notes being backed by a US$200 million loan from Afrexim Bank were false.

Such statements have significantly damaged the credibility of ZiG, eroding public confidence. The government’s desperate attempts to stabilize the currency through coercive measures seem equally futile. Despite claims of substantial gold and foreign exchange reserves, these strategies have yet to prove their efficacy.

Historically, while Zimbabwe has a rich tradition of gold mining and trading, it has never used gold as a standalone currency. The myth propagated by officials that gold was historically the economic anchor of Zimbabwe is simply untrue. Agriculture has always been the cornerstone of Zimbabwe’s economy, not gold. The country participated in the gold standard during colonial times by trading gold but never adopted gold as its currency.

The misrepresentations extend back to Zimbabwe’s monetary history, which is often oversimplified or distorted by officials. A more accurate account, as provided by Dr. Tinashe Nyamunda, a lecturer in Economic and Social History at the University of Glasgow, reveals that Zimbabwe’s monetary systems have evolved significantly over time. From the use of Sterling during the colonial period to the introduction of the Rhodesian dollar, which was at par with the British pound until Zimbabwe’s independence in 1980, the journey has been complex.

The Rhodesian dollar itself was introduced shortly before Rhodesia declared itself a republic in 1970. This move was made as Rhodesia was excluded from the Sterling area and its participation in the International Monetary Fund ceased. The currency was primarily a product of political circumstances rather than economic stability.

As Zimbabwe faces yet another economic challenge with the introduction of ZiG, it is crucial to confront these historical inaccuracies and misrepresentations that hinder genuine understanding and trust among the populace. The ongoing economic instability, fueled by misleading statements and a lack of transparent policy, continues to challenge the country’s financial system.

In conclusion, while the introduction of new currencies like ZiG is an attempt to stabilize the economy, the success of such measures will heavily depend on honest and clear communication from government officials. As Zimbabwe navigates through these turbulent economic waters, revisiting and correcting the narrative around its monetary history is essential. This is not just about setting historical records straight but about restoring faith in the systems that govern the nation’s economy.